With over 219,000 residents, Frisco, TX is one of the fastest-growing cities in the nation. The demand for homes for sale in Frisco TX outweighs the available supply, with fewer family houses currently on the market at any given time.

So, if you find the right house for your family through a realtor, make sure you know they're not making you believe any of these common myths:

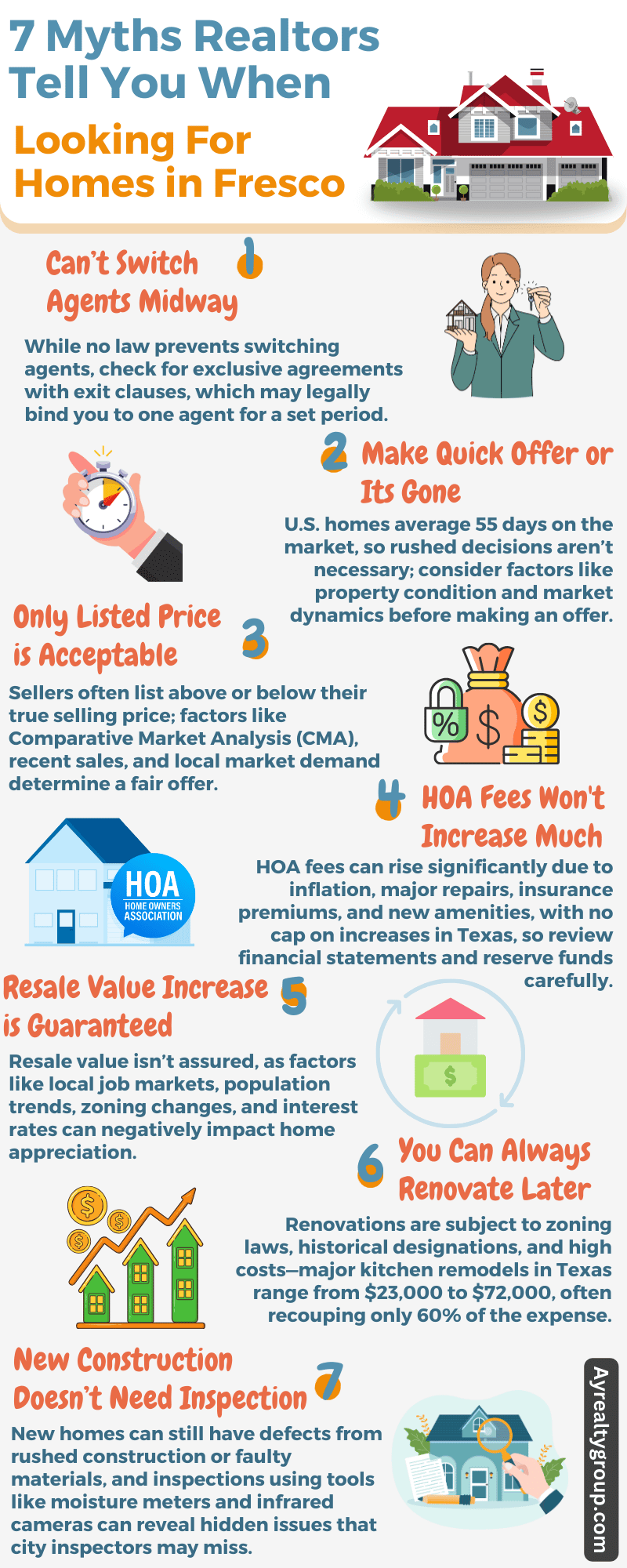

Don't believe you're stuck with one agent throughout your home search. Here's what you need to know.

Changing real estate agents mid-search isn't taboo. While politeness suggests sticking with one, no law demands it. But watch out for exclusive agreements. These can tie you to an agent for a set time. Always read contracts carefully before signing. Look for exit clauses. They spell out how to end things if needed.

Consider these factors before switching agents:

Remember, a good agent-client fit is crucial. Don't settle for less. Your home purchase is too important. If you're unhappy, speak up. Most agents want satisfied clients. They may address your concerns or agree to part ways amicably.

This claim often causes unnecessary stress. Let's debunk it with facts and figures.

Some realtors use this tactic to make quick decisions. But it's not always true. Market speed varies widely. As of September 2024, U.S. homes spent an average of 55 days on the market—nearly two months! Frisco, TX, might differ, but you usually have time to think.

Factor | Consideration |

Days on Market (DOM) | Check similar properties in Frisco |

Price Trends | Are prices rising or falling? |

Seasonal Patterns | Spring is often busier than winter |

Local Economy | Job growth can speed up sales |

Rushing can lead to regrets. You might miss crucial flaws. Or overpay in your haste. Take time to research and reflect. A day or two rarely makes or breaks a deal. If it does, was it really the right house for you?

Savvy buyers consider these points before making offers:

Don't let fear drive your biggest purchase. A good realtor guides you without pressuring you. They provide market insights, not scare tactics. Use their knowledge, but trust your instincts, too. Your perfect home is worth the wait.

Do you think the asking price is set in stone? Think again.

Home prices aren't fixed. They change based on many things. Sellers might ask for more or less than they'll take. It depends on the market, how fast they want to sell, and local trends. In Frisco, TX, the number of homes sold is up 5% from last year in 2023, which can affect prices.

In hot markets, homes often sell above the asking price. Why? Buyers compete and bid up prices. But in slower markets, you might pay less than the list price. It's all about supply and demand.

Market Type | Typical Price Outcome |

Hot (Seller's) Market | Often above the asking price |

Balanced Market | Close to the asking price |

Cool (Buyer's) Market | Often below the asking price |

Savvy buyers use tools to gauge fair prices. These include:

Don't assume the list price is final. Research the market. Make an offer based on facts, not just the asking price. A good realtor can help you decide what's fair.

Beware of this myth about Homeowners Association (HOA) fees. They can rise more than you think.

HOA fees often go up over time. Why? Services costs increase, and buildings need repairs. Insurance gets pricier. In Texas, there's no cap on HOA fee hikes. They can go up as much and as often as needed.

Factors that can drive up HOA fees include:

Watch out for special assessments, too. These are one-time fees for big projects, and they can be thousands of dollars. You might have to pay them in addition to regular HOA fees.

Document | What to Look For |

Financial Statements | Current financial health |

Reserve Study | Planned future expenses |

Meeting Minutes | Discussions about fee increases |

Before buying, review these HOA documents. They can hint at future fee increases. Ask about the HOA's history of fee hikes. Look for patterns. This helps you budget for potential increases.

Remember, HOA fees are part of your housing costs. Factor in possible increases when planning your budget. Don't let surprise hikes strain your finances later. A good realtor should help you understand these potential costs.

Don't bank on automatic property value growth. It's not a sure thing.

Home values can go up or down. Many things affect this. Local jobs matter, as does population change. New buildings nearby can help or hurt, and even big economic shifts play a role. Nothing's certain in real estate.

U.S. home prices have grown on average, rising about 4.7% annually since 2000. But this isn't the same everywhere. Some areas boom, and others struggle. Your home might not follow the average.

These all impact your home's future value. Tools like the Case-Shiller Index track regional trends and show how prices change over time, but they can't predict your specific home's future.

Factor | Potential Impact on Value |

Strong local economy | Likely positive |

Declining population | Often negative |

New amenities nearby | Usually positive |

Rising interest rates | Can be negative |

Smart buyers look beyond promises of guaranteed growth. They study local trends and consider future plans for the area. A good realtor provides insights, not empty guarantees. Always do your own research, too.

Thinking of buying a fixer-upper? Renovations aren't always simple or cheap.

Yes, you can change things later. But it's not always easy. Rules and budget can get in the way. Some homes have strict limits on changes, and others have hidden problems that cost a lot to fix.

Consider these potential roadblocks:

Renovations in Texas can be pricey.

It depends on the size and what you want. These prices can vary a lot based on where you live.

Remember, renovations don't always pay off fully when you sell. In Texas, most only recoup about 60% of their cost in added value. That new $50,000 kitchen might only add $30,000 to your home's price.

Before buying, inspect the home thoroughly, ask about renovation potential, check local rules, and budget for future work. Sometimes, finding a move-in-ready home is smarter. A good realtor can help you weigh these options.

New doesn't always mean perfect. Even brand-new homes can have hidden problems.

Many think new homes are flawless. But that's not true. Builders make mistakes, and they might rush to finish. Subcontractors can mess up, and even materials can be faulty. These issues aren't always visible to the untrained eye.

A professional inspection for a new home usually costs $200 for under 1,000 sqft and $400 for over $2,000 sqft on average. It might seem unnecessary. But it can save you thousands later. Inspectors use special tools. They find things you can't see. For example:

New home buyers should also know about:

Item | Why It's Important |

Builder's Warranties | Know what's covered and for how long |

Final walkthrough | Your chance to spot obvious issues |

Local building codes | Ensure your home meets all requirements |

City inspectors check for code compliance. But they don't work for you. A private inspector does. They look out for your interests. They find issues the builder might miss or ignore.

Don't skip the inspection just because the home is new. It's a small cost for peace of mind. A good realtor will encourage this step. They know it protects you in the long run.

Let's talk money. How much do Texas realtors typically charge?

In Texas, most realtors charge 5-6% of the home's sale price. The buyer's and seller's agents usually split this fee. The seller pays it when the house sells.

Here's a breakdown of how it might look:

Home Sale Price | Typical Realtor Fee (5-6%) |

$300,000 | $15,000 - $18,000 |

$500,000 | $25,000 - $30,000 |

This fee covers a lot of work. Realtors do more than just show houses. They:

Remember, this fee is negotiable. Some realtors might charge less, and others might offer different service packages. It's okay to ask about fees upfront. A good realtor will be transparent about their costs.

Is it worth it? That depends on your situation. For many, a realtor's expertise saves time and stress. They often help get better prices, too. But some people prefer to handle things themselves.

When choosing a realtor, don't focus only on fees. Look at their experience and track record, too. Slightly higher charges might still be worth it for a top-performing agent. They could get you a better deal overall.

With inventory constantly changing, it's important for buyers in Frisco to cut through myths that could cost them their dream home.

AY Realty can guide clients past sales pitches with honest advice tailored to today's heated housing market. Contact our team to find the right homes for sale in Frisco, TX, before they're gone.