According to recent reports, Homes for Sale in Denton, TX, have seen a 4.2% price increase over the last year. With this rise in the real estate market, many homeowners and prospective buyers are evaluating their options when purchasing a property. Two of the main choices include buying a condo or single-family home.

Both condos and single-family homes have advantages and limitations, so choosing between these two popular types of residential property can be challenging.

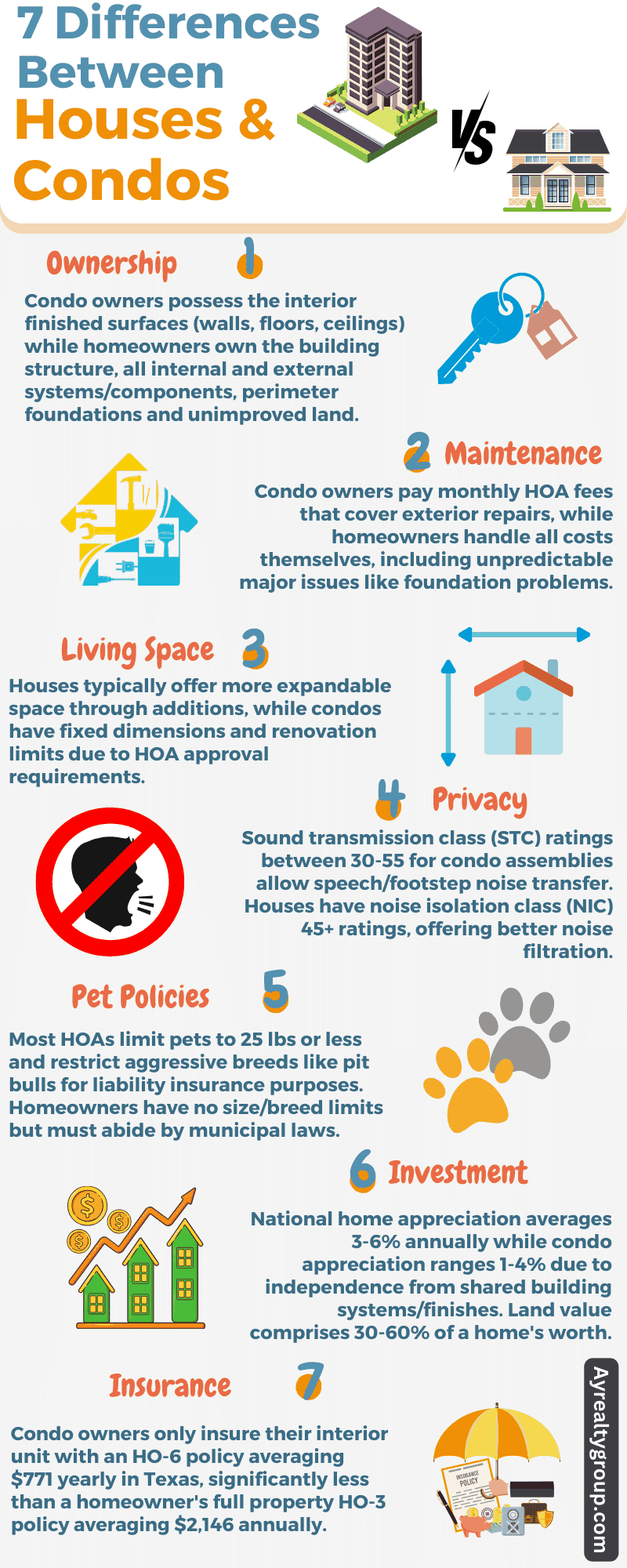

Condo and house ownership differ significantly depending on what you own.

Condo owners possess only their unit's interior. Common areas are shared. Houses grant full ownership of structure and land. Condo deeds cover individual units. HOAs control common spaces through master deeds. House owners get warranty deeds for complete property control.

Condo | House |

Own interior unit only | Own entire property |

Share common areas | Full land ownership |

Individual unit deed | Warranty deed for all |

Condo ownership can feel limiting. You can't freely modify shared spaces. Houses offer more freedom. You control all aspects of your property. This impacts resale value, too. Houses typically appreciate faster than condos.

Maintenance responsibilities vary greatly between condos and houses.

Condo owners pay HOA fees for exterior upkeep, while house owners handle all maintenance themselves. Condo living means no yard work or snow shoveling, while houses require personal time or hired help for these tasks. HOA fees for multifamily units usually range from $300-$309 monthly.

Condo living means predictable monthly costs. Houses bring variable expenses. You might save money for some months. But big repairs can hit hard. Condos offer convenience. Houses give control. Your choice depends on lifestyle preferences and budget constraints.

Living space differs greatly between condos and houses.

Houses generally offer more room to spread out. You'll find larger floor plans and outdoor areas. Condos have fixed dimensions with little room for growth. Want to expand? Houses let you build additions. Condos limit your options severely.

Condo | House |

Fixed-size | Expandable |

Limited renovation options | Full renovation control |

HOA approval needed | No external approvals |

Renovating a condo? Expect hurdles. HOAs often restrict changes, and even interior work needs approval, which adds time and costs. Homeowners face fewer barriers. They control all aspects of their space. Want to knock down a wall? Go for it.

Space needs vary by lifestyle. Large families often prefer houses, while singles or couples might find condos sufficient. When choosing, consider future needs. Houses offer more flexibility as life changes.

Privacy levels differ significantly between condos and houses.

Houses provide more seclusion from neighbors. You control your surroundings. Condos mean living closer to others. Shared walls and common areas reduce privacy, and noise can be a major concern in condos.

Condo | House |

Shared walls | Standalone structure |

STC 50+ soundproofing | NIC 45+ rated assemblies |

Common area interactions | Limited neighbor contact |

Condo construction typically uses STC 50+ soundproofing between units, but impact noises still transfer. Houses require noise isolation class (NIC) equal to or over 45 rated assemblies per IBC.

Privacy needs vary by person. Some enjoy condo community life, while others prefer house seclusion. Consider your tolerance for neighbor proximity. Houses offer more buffer space and noise control.

Pet ownership rules differ greatly between condos and houses.

While California law requires HOAs to allow at least one pet, Texas doesn't have such regulations, and it's up to the landlord or HOA to decide. The good thing is that most HOAs permit two pets.

However, house owners face no such limits. HOAs typically restrict pets to 25 pounds or less. Some ban aggressive breeds, following city rules. Homeowners choose freely, within legal bounds.

Condo | House |

Usually, 1-2 pets allowed | No set pet limits |

Weight restrictions common | Owner discretion on size |

Breed limitations possible | All breeds allowed (city rules apply) |

Condo living can challenge pet owners. Space limits affect animal comfort, and shared walls mean noise concerns. Houses offer yards for pets, and neighbors are farther away, reducing complaints. Consider your pets' needs when choosing.

Pet lovers often prefer houses, as they offer more flexibility. Condos work for those with fewer, smaller pets. Always check specific HOA rules before buying, as they vary widely.

Condos and houses differ as investment properties.

Houses often appreciate faster due to land value growth. Condos cost less initially, attracting new investors. According to the National Association of Realtors, in 2024, condos gained 2.5% value, while houses jumped 4.2%. Land ownership drives this difference.

Condo | House |

Lower entry cost | Higher initial investment |

2.5% appreciation (2024) | 4.2% appreciation (2024) |

No land ownership | Includes land value |

Houses offer more control over property value, and renovations directly impact worth. Condo values depend on building conditions. HOA decisions affect your investment. Consider market trends in your area.

Investment goals matter when choosing. Condos suit those seeking passive income, while houses appeal to long-term value seekers. Consider your budget and market knowledge. Both can be profitable with proper management.

Condo owners only need to insure their units' interiors, while the homeowners' association (HOA) covers insurance for the building's exterior and common areas. This means that condo owners typically have lower insurance costs compared to homeowners.

Type of Property | Average Annual Insurance Cost |

Single-Family Home (National Average HO-3 Policy) | $1,411 |

Single-Family Home (Texas Average HO-3 Policy) | $2,146 |

Condo (National Average HO-6 Policy) | $488 |

Condo (Texas Average HO-6 Policy) | $771 |

Homeowners must purchase property insurance, also known as homeowner's insurance or HO-3 policies, to cover the structure of their house as well as any other structures on the property, like a garage or fence. They are responsible for ensuring the full replacement value of the building and land. According to industry statistics, the average annual cost of an HO-3 policy in the United States is $1,411. In Texas specifically, the average HO-3 policy costs $2,146 per year.

On the other hand, condo owners need an HO-6 policy, which is a condominium unit owners' insurance policy. This policy mainly covers the interior of the individual unit and personal belongings. It does not cover the outside of the building or other common areas, which are insured by the condo association's master policy. Nationally, the average annual cost of an HO-6 policy is $488. On average, do owners living in Texas can pay around $771 per year for HO-6 coverage on average

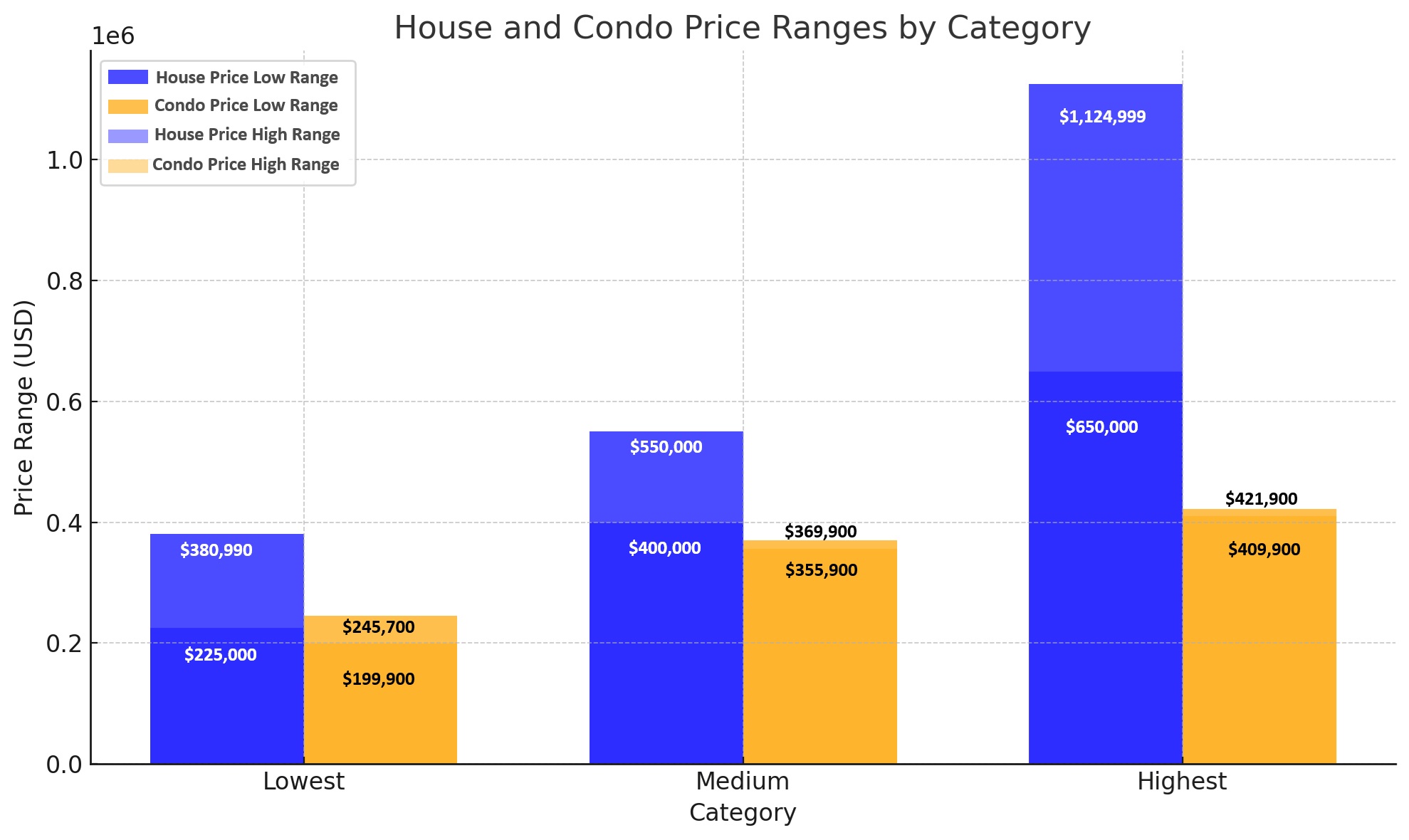

Here’s the graphical representation of prices between condos and houses in Denton Texas. These ranges are taken from Realtor.com to give you a general idea:

Here’s the table representation of same data along with some more insights categorizing the condos and house comparison by price range, including the area and price ranges:

Category | Type | Area Range (sqft) | Price Range |

Lowest | House | 1,322 to 1,791 | $225,000 to $380,990 |

Lowest | Condo | 955 to 1,139 | $199,900 to $245,700 |

Medium | House | 2,003 to 3,007 | $400,000 to $550,000 |

Medium | Condo | 1,622 to 1,684 | $355,900 to $369,900 |

Highest | House | 3,717 to 4,150 | $650,000 to $1,124,999 |

Highest | Condo | 1,866 to 1,922 | $409,900 to $421,900 |

When comparing the houses and condos, a few key observations can be made:

First-Time Homebuyers:

Young Professionals and Students:

Empty Nesters or Downsizers:

Whether you are looking for a condo, single-family home, or any other residential or commercial property, the experienced agents at AY Realty can assist you in finding homes for sale in Denton Tx. Our team members have expertise in analyzing property details, conducting competitive market research, and negotiating deals on behalf of clients. We aim to make this significant investment as simple and stress-free as possible. Contact us today to schedule a consultation with one of our licensed professionals.